A Beijing meat stall accepts cashless payments through the use of QR codes. China was the least cash-dependent country in Asia in 2022. Photo by Reuters.

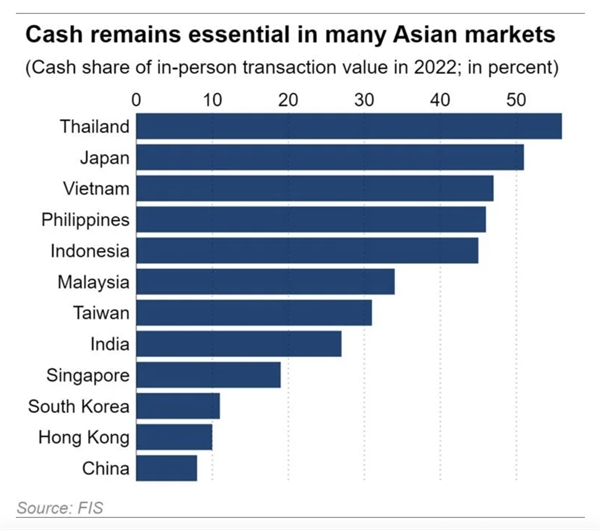

Thailand, Japan and Vietnam lag in Asia's digital payments rush

Among the region's in-person transaction value in 2022, the share of cash in Thailand was the highest at 56%, followed by Japan at 51% and Vietnam at 47%, according to U.S.-based banking and payment processing company FIS.

The company's annual report tracked consumer payment trends when shopping online and at the physical point of sale across 40 countries and economies.

Even though Thailand has made significant strides in increasing its banked population in recent years, "traditionally high rates of unbanked consumers has meant [payment] cards never made strong inroads," FIS noted.

For in-person transactions, digital wallet usage in the country followed cash at 23%, while credit cards and debit cards accounted for just 11% and 7%, respectively.

FIS defined digital wallets as apps that securely store payment credentials, allowing consumers to make purchases online and in person. Wallets can be funded via cash, credit and debit cards, bank transfers or mobile carrier billing.

In Japan -- a more mature economy with an aging population -- cash is still used widely, in part due to its vast ATM network and relatively higher credit card fees, making smaller merchants reluctant to accept cashless payments.

|

Within the Asia-Pacific region, Japan is expected to have the highest cash rate by 2026 at 37%, according to FIS, as other economies more quickly adopt digital wallets through superapps.

In Southeast Asia, Singapore-based Grab and Indonesia's GoTo have been expanding market share in the digital payments sector by allowing users to make cashless payments not only for their ride-hailing and food delivery services, but also in many online and in-person stores. Other popular services include MoMo in Vietnam and GCash in the Philippines.

The growth of virtual payment in Asia comes on the back of an expanding e-commerce market that grew during the COVID-19 pandemic. Southeast Asia, in particular, is seeing growth in digital wallets due to its higher unbanked or underbanked population.

"We're seeing these economies largely leapfrog cards and move directly to digital payments, especially with digital payment acceptance infrastructure becoming much more easily available to merchants via QR codes," FIS noted.

The Asia-Pacific region is projected to lead in the use of digital wallets for in-person transactions, accounting for 59% of the total $36.7 trillion regional point-of-sales market by 2026. This was higher than the Middle East and Africa at 24%, Europe at 20% and North America at 16%, FIS showed.

The share of digital wallets used in online transactions is also projected to expand in the region to 73% in 2026 -- up from 69% in the 2022 estimate.

Yvonne Szeto, vice president at payment processor Worldpay, which was acquired by FIS, noted that Asia is "at the forefront" of innovation in digital payments, leading developments in the areas of cross-border payments and central bank digital currencies.

"It is also the region where digital wallets first took hold as the dominant payment method, and that dominance shows no signs of abating," Szeto said.

Nguồn Nikkei Asia

English

English

_241415258.png)

_21258127.png?w=158&h=98)

_81523335.png?w=158&h=98)

_61041843.png?w=158&h=98)